Something is exciting about giving your home a fresh look, whether it’s redoing your outdated kitchen, updating a guest bathroom, or adding a cozy outdoor space. But for many homeowners, that excitement quickly turns into anxiety when the costs start adding up. Between materials, labor, permits, and the unexpected, remodeling can feel like a financial burden more than a joyful project.

The good news? It doesn’t have to be that way.

If you’re living in South Dakota or a similar state with a strong housing market and rising home values, you may have more financial flexibility than you think. Homeowners here are increasingly tapping into their built-up equity to fund renovations without taking on high-interest debt. It can be a smart way to pay for projects while keeping your savings intact.

Still, borrowing is just one piece of the puzzle. To truly remodel without overspending, you need a plan, and this guide is here to help you do exactly that.

Know How Much You Can Really Afford

Before you knock down a wall or start comparing paint swatches, take a good look at your finances. Set a clear remodeling budget based on how much you can comfortably spend—not just on the renovation itself but also on any related costs, like permits, tools, or temporary accommodations if the work is major.

Many homeowners assume they’ll use a credit card or dip into emergency savings, but there are better options out there. Home equity loans and lines of credit can offer lower interest rates, especially if you’ve built up value in your home over the years. For example, exploring home equity loan rates in South Dakota allows you to see what you might qualify for and whether this path fits your budget and goals. These rates are competitive and offer fixed repayment terms, giving you a clearer picture of your monthly payments, something that can be especially helpful when managing a remodel.

By knowing exactly what you can afford up front, you’ll avoid starting a project that gets out of hand halfway through.

Focus on What Adds Long-Term Value

Every project is tempting when you’re in the remodeling mindset, but not all upgrades offer a return on investment. If you’re trying to stick to a budget, focus on the rooms or improvements that give the biggest bang for your buck.

Kitchens and bathrooms are usually at the top of the list. These areas not only get the most use but also significantly influence a home’s resale value. You don’t always have to do a full-scale renovation, either. Sometimes, upgrading countertops, fixtures, or cabinet hardware makes a big difference.

If you’re planning to stay in your home for a while, you might also want to think about energy-efficient upgrades or accessibility improvements. These can improve your quality of life now and pay off in the long run if you ever decide to sell.

Always Get Multiple Estimates

Even if you think you’ve found the perfect contractor, don’t skip this step. Collecting several bids can reveal big differences in labor costs, material markups, and project timelines. It also gives you a chance to see who communicates clearly, sticks to deadlines, and understands your vision.

Avoid choosing someone just because they’re the cheapest. Sometimes, lower bids come with hidden costs or corners cut in quality. On the other hand, the highest bid doesn’t always guarantee the best work. What you’re really looking for is value and transparency.

Before you hire anyone, ask for a detailed breakdown of costs and a written timeline. It protects you from surprise charges later on and helps keep your project on schedule and within budget.

DIY When You Can, but Be Smart About It

There’s a lot you can do yourself if you’re willing to put in the time and effort. Painting a room, installing a backsplash, or assembling furniture can save you hundreds in labor. And thanks to online tutorials, even first-timers can learn quickly.

That said, be honest about your skills. Anything involving electrical work, plumbing, or structural changes should be left to the pros. Trying to cut corners here can lead to safety issues or end up costing you more in repairs later.

A good rule of thumb? Tackle the simple tasks yourself and let professionals handle anything that requires permits or specialized training.

Plan for the “Extras” You Don’t See Coming

One of the biggest mistakes homeowners make is underestimating the hidden costs. These aren’t just potential emergencies. They’re things like permit fees, tool rentals, delivery charges, and even eating out more while your kitchen is out of service.

It’s smart to set aside 10–20% of your total budget for unexpected expenses. That way, when something comes up (and it almost always does), you’re not left scrambling.

It’s also helpful to ask contractors or suppliers about additional fees upfront. The more you know, the better you can plan—and the less likely you are to overspend.

Reuse and Repurpose What You Can

Remodeling doesn’t always mean buying everything brand new. In fact, reusing or refurbishing existing materials is one of the best ways to save money and reduce waste.

You might repaint or reface your existing cabinets instead of replacing them entirely. Old furniture can be refreshed with new upholstery. Salvage stores and online marketplaces often have lightly used building materials, appliances, or fixtures at a fraction of the cost.

These strategies not only stretch your budget but also give your home a unique, personal touch that store-bought pieces can’t always match.

Stick to the Plan to Avoid Scope Creep

It’s easy to get carried away during a remodel. What starts as a bathroom update suddenly turns into a full-floor renovation. This “scope creep” is one of the fastest ways to overspend.

To avoid it, create a clear project plan and stick to it. That means locking in your design choices, finishes, and materials before work begins. If new ideas pop up, write them down and consider them for a future project rather than adjusting the current one on the fly.

Having a detailed plan also helps your contractor stay on track and reduces the risk of miscommunication or mid-project delays.

Conclusion

Home remodeling doesn’t have to be overwhelming or expensive. With careful planning, realistic budgeting, and smart financing options, you can give your space a fresh look without draining your savings.

Start by knowing what you can afford, explore financing like home equity loans with favorable rates, and always prioritize projects that bring long-term value. Combine professional work with some DIY effort, reuse where possible, and keep your plan tight to stay on track.

Your dream home upgrade is absolutely within reach. You need the right plan to get there without overspending.

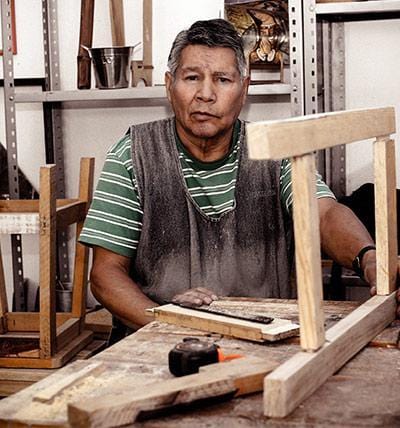

ABOUT THE AUTHOR

Fred Felton

Content Creator / Editor

Fred Felton is a copywriter, editor and social media specialist based in Durban, South Africa. He has over 20 years of experience in creating high end content. He has worked with some of the biggest brands in the world. Currently Fred specialises in the wooden arts and crafts space, focussing on innovative wooden product design. He is also a keynote speaker and has presented talks and workshops in South Africa.