Office or home office equipment is an important asset for any business. It is important to choose the right type of equipment for your needs and to maintain it properly.

Importance of Office Supplies and Equipment

If you own or manage a business, you know that having the right office supplies and equipment is important for daily operations. Not only do these items make your office run smoother, but they can also improve employee productivity and morale.

When it comes to office supplies, it’s important to have a variety of items on hand so that employees can find what they need, when they need it.

The same goes for office equipment; having the latest and greatest technology can help your business stay ahead of the competition. While it may seem like a small thing, investing in high-quality office supplies and equipment can make a big difference in the success of your business.

How to Figure out What Type of Asset is Office Equipment?

When it comes to office equipment, it's important to know what type of asset it is.

Here are a few tips on how to figure out what type of asset office equipment is. Look at the purchase price. If the equipment was expensive, it's likely that it's an asset.

Consider how long the equipment will be used. If it's something that will be used for a long time, it's likely an asset. Determine if the equipment is essential to the business. If it is, it's likely an asset. Consider the depreciation schedule. If the equipment will lose value over time, it's likely an asset.

The Benefits of Knowing What Type of Asset is Office Equipment

By knowing what type of asset is office equipment, businesses can be sure to invest in the right type of equipment for their needs. There are many different types of office equipment, from basic items like desks and chairs to more complex pieces like computers and printers. Businesses need to carefully consider what types of equipment they need to invest in, in order to run their operations effectively. One of the benefits of knowing what type of asset is office equipment is that businesses can make sure to get the most for their money. By investing in high-quality office equipment, businesses can save money in the long run by avoiding the need to replace broken or outdated equipment.

So, What is the Difference Between Office Equipment and Capital Assets?

When it comes to office equipment, there are a few key points that you should know in order to make the best decision for your business. First, office equipment is mostly considered to be a current asset, which means that it is short-term and will be used up within a year. Second, office equipment is usually not considered to be a capital asset. Now that you know the difference between office equipment and capital assets, you can make the best decision for your business. If you need something that will be used up within a year, office equipment is the way to go.

What are the Benefits of Owning Office Equipment?

If you're running a business, then you know that having the right office equipment can make a big difference. Not only can it help you to get the job done more efficiently, but it can also make your office look more professional. Here are some of the benefits of owning office equipment. You'll be able to get the job done more quickly. It can help you to save money in the long run. It can help you to stay organized. It can make your work life easier. There are many different types of office equipment, so make sure to do your research.

When it comes to office equipment, there are a variety of different types of assets that you may want to consider.

From computers to printers and even furniture, office equipment can be a significant investment for your business. When deciding what type of asset to purchase, it is important to consider what will best suit your needs. For example, if you are looking for a computer, you will want to consider what type of processor you need, how much memory you require, and what type of software you will be using. Printers are another important piece of office equipment, and there are a variety of different types to choose from.

What is an On-Balance Sheet Asset?

When you think of office equipment, you might think of items like computers, printers, and phones. But did you know that office equipment can also be considered an on-balance sheet asset? An on-balance sheet asset is any asset that a company owns and can use to generate revenue. This includes items like land, buildings, and machinery. And since office equipment is used in the day-to-day operations of a business, it falls into this category. There are a few things to keep in mind when it comes to on-balance sheet assets.

First, they can be either fixed or current assets. There is often confusion about the difference between fixed assets and current assets. Fixed assets are those long-term assets that are not easily converted to cash, such as land, buildings, and machinery. Current assets, on the other hand, are those assets that can be easily converted to cash, such as inventory, accounts receivable, and short-term investments.

What is the Difference Between On-Balance Sheet Assets and Off-Balance Sheet Assets?

When you think about assets on a company's balance sheet, you might automatically think of things like cash, inventory, and buildings. But there's another category of assets that are often overlooked: office equipment. Office equipment can be a significant investment for a company, and it's important to understand how it is classified on the balance sheet. Office equipment can be either on-balance sheet or off-balance sheet assets.

On-balance sheet assets are assets that are owned by the company and are reflected on the balance sheet. The value of on-balance sheet assets can fluctuate due to changes in the market or other factors, but the company still owns and is responsible for them. Off-balance sheet assets are those assets that are not recorded on a company's balance sheet.

These assets may be difficult to value or may be subject to future events that affect their value. Some common off-balance sheet assets include joint ventures, certain leases, and derivatives. While these assets are not recorded on the balance sheet, they can still have a significant impact on a company's financial statements.

Office Equipment is a Depreciable Asset

When it comes to office equipment, it's important to know that it is a depreciable asset. This means that over time, the value of your office equipment will decrease. However, this doesn't mean that your office equipment is worthless. In fact, office equipment can be a valuable part of your business.

Office equipment can include items such as computers, printers, fax machines, and more.

While the initial investment in office equipment can be costly, it is an investment that can pay off in the long run. Office equipment can help to make your business more efficient and productive. If you are considering purchasing office equipment, it's important to do your research.

How to Classify Office Supplies?

It's important to know how to classify office supplies so you can keep track of your inventory and budget. Classifying office supplies may seem like a daunting task, but with a little organization and some strategic thinking, it can be a breeze.

Here are a few tips on how to get started. Make a list of all the items you need to classify. This will help you keep track of what goes where.

- Start with the basics: pens, paper, staplers, etc. These items are usually easy to categorize.

- Next, move on to more specific items like file folders, binders, and labels. Again, think about how you will use these items and what would make the most sense for your needs.

- Also, it is better to classify office supplies into a few different categories: stationary, cleaning supplies, and general office supplies. Stationery includes items such as paper, pens, and notebooks.

Cleaning supplies are used to keep the office clean and tidy and might include items such as disinfectant wipes and garbage bags. General office supplies are those items that don't necessarily fall into the other two categories but are still necessary for the office, such as printer ink or paper clips. By keeping these supplies organized and in their respective categories, it will be easier to find what you need when you need it.

Office Furniture

Yes, office furniture is considered a long-term asset. This is because office furniture is designed to last for many years and can be used for multiple purposes.

For example, a desk can be used as a workstation, a meeting table, or a storage piece. Additionally, office furniture is typically made from high-quality materials that can withstand heavy use.

Final Thoughts

Office equipment is a type of asset, and as such, it can be a valuable part of your business. From computers and printers to furniture and office supplies, office equipment can help you keep your business running smoothly.

When selecting office equipment, it's important to choose items that will meet your specific needs and that are built to last. With proper care and maintenance, your office equipment can provide years of service and help you keep your business running smoothly.

Commonly Asked Questions

Where does office equipment go on the balance sheet?

On the balance sheet, office equipment would go under the category of property and equipment. This would include items such as computers, desks, chairs, and other furniture.

What is considered office equipment in accounting?

In accounting, office equipment is considered to be any type of equipment that is used in a business or office setting. This can include items such as computers, printers, fax machines, furniture, and more.

ABOUT THE AUTHOR

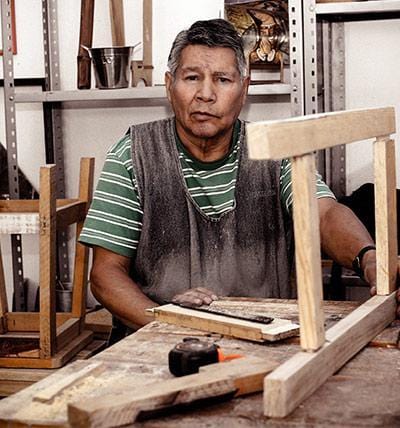

Fred Felton

Content Creator / Editor

Fred Felton is a copywriter, editor and social media specialist based in Durban, South Africa. He has over 20 years of experience in creating high end content. He has worked with some of the biggest brands in the world. Currently Fred specialises in the wooden arts and crafts space, focussing on innovative wooden product design. He is also a keynote speaker and has presented talks and workshops in South Africa.