So you're thinking of buying a starter home? Whether you're a first-time homebuyer or just looking to downsize, it's important to know what to expect. Whether you're a first-time homebuyer or just looking to downsize, it's important to know what to expect, especially when navigating through a real estate portal to find the perfect fit for your needs and budget.

This guide will walk you through the process of buying a starter home, from finding the right property to getting approved for a mortgage and choosing homewares for your house. We'll also cover the basics of homeownership, such as property taxes and insurance. So whether you're ready to take the plunge into homeownership or just want to learn more about it, read on!

Pros & Cons of Homeownership

Buying a starter home is an exciting and important step in life. It can be a major financial investment, so it's important to understand the pros and cons of homeownership before deciding to take the plunge.

Florida is a great place to live. Get instant notifications of new Florida condos here.

The following are some of the advantages and drawbacks of buying a starter home.

Advantages of Homeownership

There are several advantages to homeownership, including building equity, tax benefits, stability and security, and the freedom to customize/personalize your space; however, it's also important to understand processes like how to calculate buying someone out of a house when co-ownership situations arise.

Here are a few of the most important benefits:

1. Building Equity: Over time, your home will likely increase in value, allowing you to build equity. This is especially important if you're looking to sell in the future or use your home as collateral for a loan.

2. Tax Benefits: Homeowners may be able to deduct mortgage interest and property taxes from their taxable income, which can save you a lot of money over the years.

3. Stability and Security: Owning a home gives you a sense of stability and security that can't be beaten. You know that you have a place to call your own, no matter what happens in the economy or housing market.

4. Freedom to Customize/Personalize Your Space: One of the best things about owning a home is being able to customize it however you want. You can paint the walls any color you like, install new flooring, and install curtains or wallpaper. You can even choose which appliances and furniture you want to use.

Disadvantages of Homeownership

Upfront Costs (Down Payment, Closing Costs)

When you buy a starter home, there are typically two types of upfront costs you'll need to pay: the down payment and the closing costs.

The down payment is the amount of money you pay upfront to purchase the home.

The closing costs include all the fees associated with buying the home, such as legal fees, inspection fees, and title insurance.

Most lenders require a down payment of at least 20%, although some may require as much as 30%.

It's important to note that the down payment is not refundable, so if you change your mind after putting down the money, you won't get it back.

The closing costs vary depending on the property but typically range from 2-5% of the sale price.

You can ask your real estate agent for a breakdown of the closing costs before you make an offer on a property.

Maintenance and Repair Costs

Once you own a home, you're responsible for all ongoing maintenance, renovation and repair costs.

These can add up over time, so it's important to budget for them in your monthly expenses. Some common maintenance and repair costs include:

- Repairing or replacing appliances.

- Fixing leaks or plumbing issues.

- Painting walls or ceilings.

- Fixing broken windows.

- Replacing roofing tiles or shingles.

- Mowing lawns and trimming bushes.

Long-Term Financial Commitment

Owning a home is a long-term financial commitment. You'll be responsible for paying your mortgage monthly, even if you're not living in the property.

Plus, you'll need to set aside money for repairs and maintenance. So before buying a starter home, ensure you're prepared for the long haul!

Financial Preparation for Homeownership

Financial preparation means understanding the costs of owning a home and having enough money saved to cover those costs.

Before you buy, it's important to do your research and understand what you can afford.

Here are some of the things you should consider.

Establish Credit Worthiness

Here is a step-by-step process to prepare your credit for a mortgage loan:

- Start by checking your credit score. This will give you a good idea of where you stand and what areas you need to work on. You can get a free credit score from several different websites, including Credit Karma and Credit Sesame.

- Make sure you're paying your bills on time. This is one of the most important things you can do to improve your credit score.

- Reduce your debt-to-income ratio. Your debt-to-income ratio is the amount of debt you have compared to your income. Try to pay down high-interest debt and increase your income if possible.

- Use a credit counseling service if needed. If you're struggling to improve your credit score on your own, consider using a credit counseling service. They can help you create a plan to improve your creditworthiness and stay on track financially.

Understand Your Financial Capabilities

Before buying a home, it's important to understand your financial capabilities. So first, look at your current income and expenses to get an idea of what you can realistically afford each month. You'll also want to consider long-term costs like property tax, homeowners insurance, and maintenance. Explore our review page for insights on the best home insurance companies, ensuring your investment is protected.

You can use a mortgage calculator to help you figure out your budget. However, to better understand your financial capabilities, it's also a good idea to speak with a financial planner or mortgage lender. For instance, when considering the costs of homeownership in California, it's essential to look at various factors beyond just the purchase price. You can use tools to calculate your mortgage payments in California to help you get a precise estimate of your potential monthly payments, based on local property taxes, insurance costs, and other variables.

- Placement: After "Understand Your Financial Capabilities" section.

Consider Professional Mortgage Assistance

If you're unsure how to buy a starter home, it may be helpful to consult with professional mortgage assistance.

They can help you understand the process, find the best loan options, and submit an offer on a property.

There are several ways to get professional mortgage assistance.

- One way is to consult with a real estate agent. They can help connect you with a mortgage broker or lender who can assist you with the process.

- Another option is to speak with a financial advisor about your options. They can help you find the best mortgage loan for your needs and budget.

- Finally, you can also consult with a lawyer about the home-buying process. They can help ensure everything is in order and that you're aware of all the associated costs.

Research Home Loan Options

There are many different types of home loans available, so it's important to do your research before applying for one.

Make sure you understand each loan's interest rate, terms, and conditions before making a decision.

Also, consider the fees associated with each loan, such as closing costs and origination fees.

Finally, make sure you understand what type of mortgage insurance is required and how it will affect your monthly payment. All these factors can affect your overall affordability.

Calculate Closing Costs & Budget for Upfront Payments

Closing costs are the fees associated with closing a loan or buying a home. These costs can include appraisals, inspections, title insurance, and more.

Closing costs can vary depending on the lender and loan program, so it's important to calculate them ahead of time.

Understand all of the associated expenses so that you can budget accordingly. You'll also need to set aside money for any upfront payments due at closing, such as a down payment or earnest money deposit.

Make sure you have enough saved up to cover these payments before applying for a loan.

Hoarding cash is not a good idea, however. Instead, work with your lender to find the best loan program that fits your budget and financial goals.

Find a Reasonable Down Payment

The down payment is one of the highest upfront costs when buying a starter home.

Most lenders require a down payment of at least 20%, although some may require up to 30%.

It's important to note that the down payment is not refundable, so be sure you're prepared to make this investment before applying for a mortgage loan.

The best way to save for a down payment is to start early and put aside money each month.

Apply for a Pre-Approved Mortgage Loan

One of the best ways to ensure you're getting the best rate on your mortgage loan is to apply for a pre-approved mortgage loan.

This shows potential lenders that you're serious about buying a house and have already been approved for a certain amount of money.

Here's the best way to do it:

- Contact a Mortgage Broker: Mortgage brokers can help you find the best mortgage loan for your needs. They have access to many different lenders and can help you compare interest rates, terms, and fees. Brokers can also help you submit an offer on a property. Contact a mortgage broker in your area to get started.

- Complete a Mortgage Application: Once you've chosen a broker, they will provide you with a mortgage application to complete. This application will ask for your personal information, such as your name, address, and Social Security number. It will also ask about your employment and income information. Be sure to complete the application accurately and honestly. Any false information could lead to the denial of your loan application.

- Gather Your Documents: To support your mortgage application, you will need to provide various documents to your broker. These documents may include pay stubs, W-2 forms, bank statements, and tax returns. Be sure to have these documents ready to send to your broker as soon as they request them.

- Wait for Approval: Your mortgage broker will submit your loan application to various lenders for approval. Most applications are approved within a few days, but some may take longer, depending on the lender's processing time.

Once approved, your broker will let you know the next steps.

Manage Your Finances During the Home Buying Process

It's important to keep track of your financials during the home-buying process.

Make sure you're making payments on time and saving enough money to cover all of the closing costs. The more organized you are, the smoother the process will be! Also, avoid making any major financial decisions, such as taking out auto loans or applying for new credit cards, until after you've closed on your loan.

This will help ensure that any changes to your credit score do not impact your loan.

Decide How Much House You Can Afford to Buy

Before applying for a mortgage loan, deciding how much house you can afford is important. Take into account your income, expenses, and other debts when calculating this number.

This will help ensure you don't overextend yourself financially by taking out too large of a loan.

You can discuss this with your family or a financial advisor to come up with an amount that makes sense for your budget.

Review Your Credit Report Before Applying for a Mortgage Loan

Your credit score is one of the most important factors lenders consider when determining your loan eligibility.

Before applying for a mortgage, review your credit report to make sure everything is correct.

The report will show you any accounts that are in default or late, as well as any negative marks from creditors.

It's important to dispute any errors and improve your credit score before applying for a loan.

Make Sure Your Bank Account is in Good Standing During the Process

Your bank account will be closely monitored during the home-buying process, so you'll want to ensure it's in good standing.

Make sure all payments are up-to-date and don't forget to keep money aside for closing costs and any unexpected expenses that may arise during the process.

Choosing an Ideal Home

Create a List of Priorities and Needs in a Home

Before you begin your search for a starter home, make sure to create a list of priorities and needs.

List out the essential features that you require in a home, and think about what type of location is most desirable for you.

Analyze Your Local Real Estate Market

Take some time to familiarize yourself with the local real estate market so you can find the right properties at the right prices.

Research current trends, average listing prices, and any other relevant information to make sure you're making an informed decision.

Visit Properties in Person Before Making an Offer

It's important to visit potential homes before deciding on one. Make sure to check out all of the features in person and get a good sense of the neighborhood.

Before making an offer, this will help you determine if the home is right for you.

Compare Different Home Types on the Market

When searching for a starter home, it's important to compare different types of homes and decide which one fits your needs and budget best.

Consider researching homes like single-family, condos, townhouses, and apartments to see which is the best fit for you.

Explore Neighborhoods to Find the Right Fit

Before settling on a home, make sure to explore different neighborhoods in the area. This will give you an idea of what type of people live there and if it's really right for you.

Pay attention to things like schools, parks, and safety to make sure it's a good fit.

Consider the Resale Value of a Home and Location Impact

When searching for a starter home, make sure to consider the resale value of the property.

Look at locations and amenities that could be attractive to buyers if you ever decide to sell in the future. It's important to think about these factors before making your decision.

Initiating the Process

Hire a Professional Real Estate Agent or Broker

When it comes to buying a starter home, it's important to have a professional on your side.

Hire a real estate agent or broker who will help you navigate the process and ensure you get the best deal possible.

They'll also be able to give you expert advice on what to look for in a starter home.

In addition, it’s beneficial to consider local expertise when choosing your real estate professional. For instance, Estate agents Four Oaks are well-versed in the local market and can provide valuable insights that can help you make an informed decision. Their knowledge of the area and its properties can be a great asset in your home buying journey.

Distinguish Between Buyer's Agent and Seller's Agent

When hiring a real estate agent, it's important to distinguish between the buyer's and seller's agents.

The buyer's agent will represent you in the transaction, while the seller's agent will represent the seller.

Make sure to ask questions and research before deciding which one is right for you.

Research Your Local Laws & Regulations for Buying a Home

It's important to do some research on local laws and regulations when buying a starter home.

Check with local governments or agencies to make sure that all requirements are met so that you can have a smooth transaction.

Negotiate Terms with the Seller or Their Representative

When buying a home, it's important to negotiate terms with the seller or their representative.

Come up with an offer that both parties can agree on, and make sure to ask any questions you have about the property.

Choose a Home Inspector and Have the Property Inspected Thoroughly

Choosing a professional home inspector when buying a starter home is essential.

Make sure to have them inspect the property thoroughly so they can report any issues that need to be fixed before closing. This will help protect your investment in the long run.

Closing the Deal

Understand All of the Terms in Your Mortgage Loan Agreement

When taking out a mortgage loan for your starter home, make sure to read the agreement carefully and understand all of the terms. This will help you avoid any misunderstandings in the future.

Sign the Closing Documents and Pay Due Costs & Fees

You'll need to sign the closing documents and make sure that all costs and fees due are paid before finalizing your purchase.

Make sure to review everything carefully before signing so you can be confident in making this investment.

Receive Keys to Your New Home!

Once all of the paperwork is signed off on, it's time to receive the keys to your new home! Make sure to take pictures or videos of yourself getting the keys so you can always look back on this special moment.

Finalize the Sale with Escrow Services or a Title Company

The final step in buying your starter home is to use escrow services or a title company to finalize the sale.

They'll collect all of the funds, handle paperwork, and ensure that everything is done according to state laws and regulations.

The Top Ten Tips From Homeownership Experts

- Research your area: Before taking the plunge into homeownership, it is important to research what type of home will work best for you and your family. Consider things like schools, commute times, and neighborhood amenities that are important to you.

- Establish a budget: Once you know what type of home is right for you, establish a budget for yourself so that you don't overspend or become overwhelmed with debt. Make sure to factor in additional costs such as utilities, maintenance and repairs, taxes, insurance, and more when setting your budget.

- Save up: You should ideally save enough money so that you can put 20% down on your home purchase. This will help you avoid paying private mortgage insurance (PMI) and position you to get the best interest rate.

- Get pre-approved: It's important to get pre-approved for a loan before you start house hunting so that your offer will be taken seriously. Pre-approval also gives you an idea of what type of home you can afford and how much money you'll need to put down.

- Find a real estate agent: A good real estate agent is essential when it comes to finding a home within your budget and navigating the entire process successfully. Make sure to do your research and find one who is knowledgeable, experienced, and has a good track record in the area where you are looking for homes.

- Look into home inspections: Before you make an offer, it is important to hire a professional inspector to look for any potential issues with the home. The inspector should be able to detect structural problems and other issues that could negatively affect your purchase or cost you money down the road.

- Understand closing costs: When shopping for a loan, ask about closing costs and understand what they include. Depending on the lender, these can range from attorney fees to title insurance.

- Negotiate wisely: Once you've made an offer on a home, it's best to negotiate cleverly so that you get the best deal possible for yourself and your family. Consider bringing in a lawyer who can help you with the legal aspects of the transaction.

- Prepare for unexpected costs: Even if you've done your due diligence, some unanticipated costs may be associated with buying a home. Make sure to set aside some money in case these come up so that you don't get stuck in a financial bind.

- Get ready for move-in day: Once all the paperwork has been signed and you are officially a homeowner, it's time to start packing! Make sure to do an inventory of what you need to move and any additional items or services, such as movers, that might be required. Be organized and plan ahead so that moving day is smooth and stress-free.

Having Fun After Closing

Now that you have closed on your home, it is time to celebrate!

Moving into a new house is an exciting milestone, so don’t forget to take a moment and enjoy the accomplishment. Here are five ways to spruce up your home and celebrate the big day:

Take some time to decorate – This can be one of the most fun parts of homeownership. Look for furniture, artwork and accessories that complement each other and express your style. It can also be affordable if you shop around for the best deals.Invest in smart home products – Smart home technology has come a long way in recent years and there are now plenty of options available to make your life easier.

Consider adding voice-activated lights or appliances, remote door locks, automated thermostats, or even robot vacuums that can keep your floors clean with minimal effort from you!

Frequently Asked Questions

How can I save up for a down payment?

Saving up for a down payment can take time, but there are several strategies that you can use to reach your goal.

Start by tracking all of your spending and commit to putting money aside each month.

You could also consider investing in the stock market, using bonus or tax refunds, or tapping into other sources of income, such as rental properties.

What type of mortgage should I get?

The type of mortgage that is best for you depends on what kind of home you are buying and how much money you have saved for a down payment.

Generally speaking, conventional loans require a higher down payment than FHA or VA loans, but they tend to offer lower interest rates over the life of the loan.

Talk to a knowledgeable lender about your financial situation to determine your best option.

Is it better to buy an existing home or build one from scratch?

This is largely a personal preference, as both have their own benefits and drawbacks.

Building a home from scratch can give you more control over the design and customization of your property.

However, buying an existing home may be simpler in terms of paperwork and save you time down the road. Consider your lifestyle, budget, and priorities when making this decision.

What documents do I need while applying for a mortgage loan?

When applying for a mortgage loan, lenders will typically require certain documents such as proof of income, tax returns, banking statements, pay stubs, and credit reports.

Depending on your individual circumstances, the lender may also request additional documentation. Be prepared with these documents to ensure a smooth process.

When is the best time to buy a house?

The best time to buy a home depends on factors such as your financial situation, desired location, and availability of homes in your area.

Generally speaking, spring and summer are the busiest times for real estate, but you can find deals throughout the year if you know what to look for.

Do some research into local market trends before deciding when to purchase.

How much can I realistically afford in terms of monthly payments and upkeep costs?

Your budget should consider your mortgage payments and other associated costs such as taxes, insurance, repairs and maintenance, utilities, and furnishings.

Make sure to include these costs in your calculations, as well as any potential increases that may occur over time.

It is important to be realistic about what you can afford so that you don't stretch yourself too thin financially.

Are there any tax implications to consider when buying a house?

Yes, there are several tax implications associated with buying a home. You may be eligible for certain deductions, such as mortgage interest or property taxes, which could save you money in the long run.

Talk to a qualified accountant or financial advisor to learn more about how taxes might affect your purchase.

Conclusion

Congratulations on becoming a homeowner! Owning a home is an important milestone achievement and comes with many responsibilities.

Be prepared for regular maintenance and upkeep requirements, such as cleaning, repairs, and landscaping.

Enjoy your new home and celebrate this milestone achievement! If you find this guide helpful, share it with your friends and family.

Good luck!

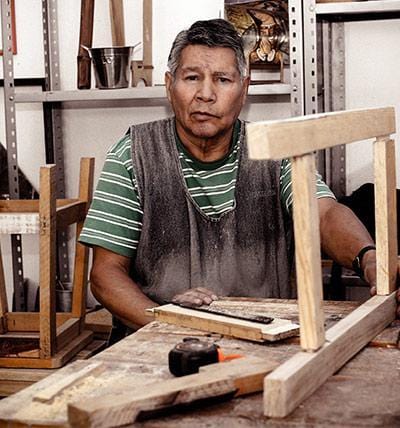

ABOUT THE AUTHOR

Fred Felton

Content Creator / Editor

Fred Felton is a copywriter, editor and social media specialist based in Durban, South Africa. He has over 20 years of experience in creating high end content. He has worked with some of the biggest brands in the world. Currently Fred specialises in the wooden arts and crafts space, focussing on innovative wooden product design. He is also a keynote speaker and has presented talks and workshops in South Africa.