For millions of Americans, having to tighten their belts has been a terrible reality throughout the past several years.

The U.S. Bureau of Labor Statistics reports that although annual inflation rates are still at 6%, food, rent, and energy costs have grown by up to 10%.

Is there a way to get out of this predicament without having to spend all of your savings?

Here are the top strategies that will help you budget and afford to buy necessary things.

Avoid collecting new debt

It is important to avoid taking new loans, especially variable-interest ones, as they reinforce the debt cycle and reduce your financial flexibility. Instead of taking a loan, consider borrowing from your family, finding a side hustle, or applying for a financial assistance program.

If you have decided that the loan is necessary, consider omitting variable-rate debts and choosing low-interest rates with a longer repayment period. You can check available lenders’ interest rates for personal and payday loans and terms and conditions on Payday Depot or similar platforms.

Start monthly budgeting

Often associated with frugal spending, budgeting is a great technique that will allow you to relocate your resources to necessary things, increase your savings, keep an eye on your spending, and gain fresh perspectives on your spending habits. The 50/40/10 rule is a popular one in budgeting, where you allocate 50% of your income to necessities (including paying taxes), 40% to wants, and 10% to savings or debt reduction. You can minimize spending on trivial items, put money aside for an emergency fund, and get more control over your finances by creating monthly budgeting plans.

Try to shop differently

Changing your spending habits can take some time, but it will have a big impact on your wallet. Don’t overpay for expensive brands; buy local food, add some frozen food to your diet, and try to buy only the necessary products. Pay attention to sales and discounts, and take advantage of coupons and bargains. Consider postponing big purchases like a house, a car, or other expensive items, as they will add to your debt burden.

Cut back on rent and utility bills

Depending on your current living situation and the tariffs on the market, you can find a roommate to split the rent. There are multiple ways to cut costs, from searching for cheaper accommodations to downsizing into a smaller room and dodging real estate agents. If you’re looking to cut back on your utility expenses, you can buy energy-efficient light bulbs, adjust the temperature in your house to avoid overpaying, choose cheaper tariffs, and change your provider.

To sum up, elevated inflation rates have affected millions of Americans. Starting with changing your spending habits and starting monthly budgeting, ending with changing providers to cut back on utilities — there are multiple ways to combat the inflation rates. By incorporating these simple strategies into your daily routine, you will be able to adjust to the situation seamlessly and save money.

ABOUT THE AUTHOR

Aleksandra Djurdjevic

Senior Content Creator

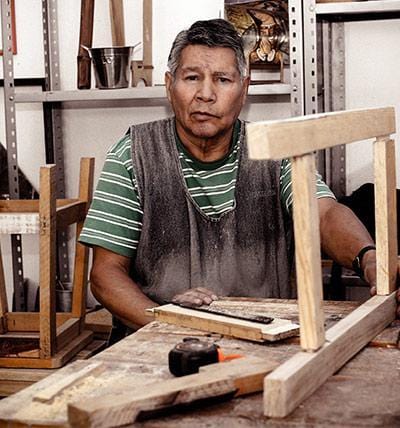

Aleksandra Djurdjevic is a senior writer and editor, covering jewelry, accessories, and trends. She’s also works with services, home décor. She has previously worked as ESL teacher for English Tochka. Aleksandra graduated from the Comparative Literature department at the Faculty of Philosophy in Serbia. Aleksandra’s love for the environment, crafts and natural products over the years helps her continue to be a top expert at Wooden Earth.